Paying taxes can be a big responsibility. Find out how to file your taxes and other contributions as a freelancer.

So: when was the last time you complained about the traffic?

Can’t remember?

Perhaps the terrible commute to and from the office was what convinced you to become a freelancer in the first place. With a lot of Filipino salarymen getting stuck on a daily basis in clogged roads, with vehicles snaking through thoroughfares that can barely accommodate the millions of cars, no wonder online freelancing has become one of the most appealing routes to escape the craziness that is our unmanageable traffic.

But while self-employed professionals no longer have to suffer the commute (along with the strict dress codes and the insufferable officemates), the constant worry about their next paycheck (once the so-called “drought” season kicks in) along with paying for insurances and government contributions have replaced the usual concerns a normal eight-to-fiver experiences.

And those who have now quit their jobs for online work must remember: what better way is there to contribute to nation-building and improving public infrastructures (short of jailing corrupt politicians and voting for better people come election season) than paying the right amount of taxes?

But here the lies the rub: filing taxes and paying for SSS, Pag-Ibig, and Philhealth might sound noble and smart, but the process admittedly can be confusing for many freelancers who used to rely on their previous company’s Human Resources personnel to do the work for them.

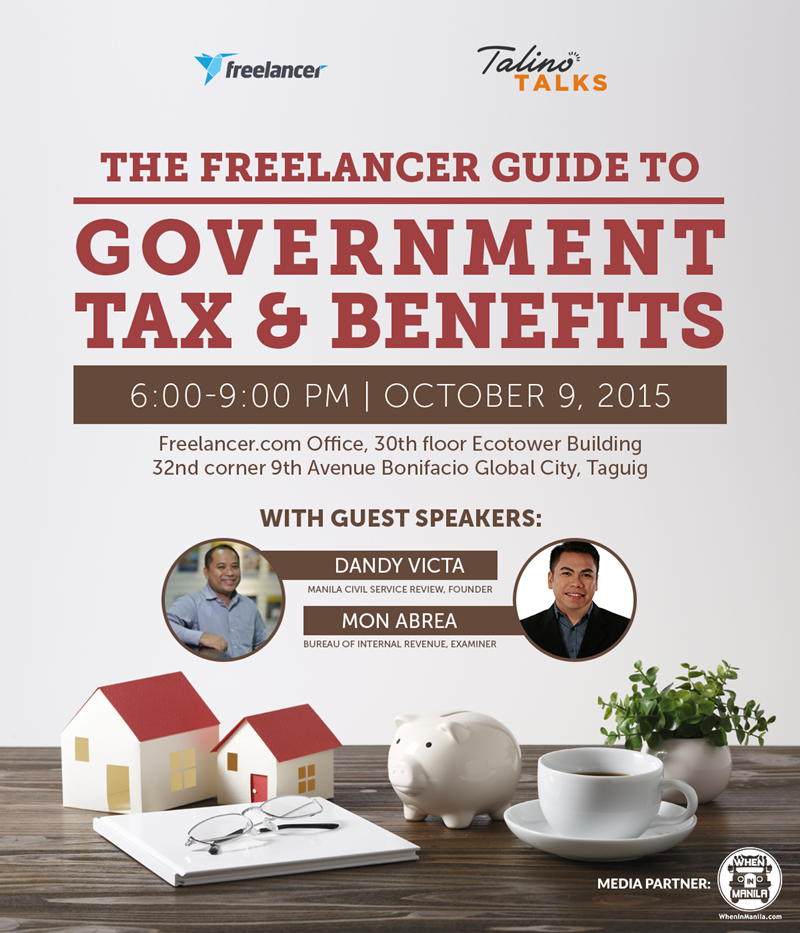

To educate wannabe and established freelancers on the process, Freelancer.com, the world’s leading freelancing and crowdsourcing marketplace, together with premier workshops organizer Manila Workshops and media partner WheninManila.com, invites freelancers to join former Bureau of Internal Revenue examiner and prominent advocate of genuine tax reform Mon Abrea, and Dandy Victa, the founder of Manila Civil Service Review, in an educational event on taxation and benefits for Filipino freelancers.

In the Talino Talks workshop entitled “The Freelancer Guide to Government Tax & Benefits”, the experts will brief you exactly why taxes and government benefits like SSS, Pag-ibig, and Philhealth matter for every Filipino freelancer.

“The upcoming Talino Talks aims to answer the most frequent questions freelancers have about paying taxes and contributions. It is important that freelancers learn how to properly pay their taxes and know the benefits they will get from their contributions.” said Freelancer.com Regional Director for Southeast Asia, Evan Tan.

The Talino Talks workshop is happening on October 9, 2015, 6 to 9 pm, at the Freelancer.com office, 30th floor, Ecotower Building, 32nd cor 9th Avenue, Bonifacio Global City, Taguig.

RSVP here: http://manilaworkshops.com/events/taxation

Want to get free seats? Tweet about the event and tag @freelancerphils, or share the Facebook image (make sure to that your sharing settings are available to public!) from the Freelancer.ph Facebook page! Don’t forget to use the hashtag #TalinoTalks.

And a friendly reminder: the event happens on a Friday, by the way, so make sure to leave your house early–just in case you’ve forgotten how bad Friday traffic can get. (Aren’t you happy there’s such a thing as online freelancing?)